Hi,

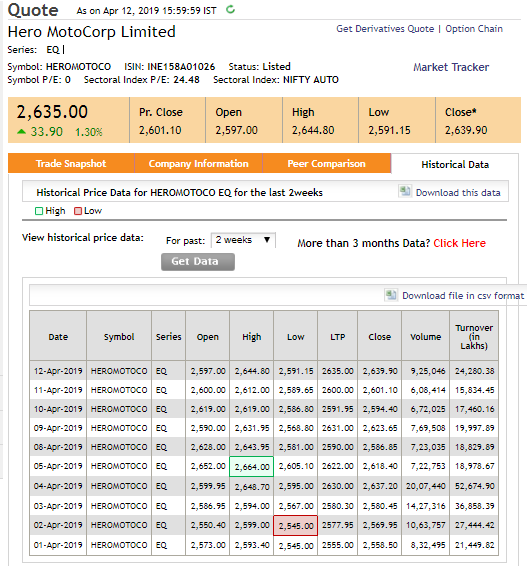

Watch Hero Motocorp Ltd. (NSE symbol:HEROMOTOCO )

The stock closed on 2639. It is likely to try for 2740-49 and 2790-99 in coming sessions.

Best buying range @ 2610-2625. If unable to get it at this price then Buy when it crosses 2650

Stop loss @ 2600

Risk : 10-50 points

Reward : 115-174 points

Expected holding period: 45 days

Edit : 16-Apr-2019

Hope you were able to make some money as per my recommendations above given on 12-Apr-2019. The stock gave buying opportunity at 2650 on 15-Apr-2019 and today it hit the first target of 2749 as predicted. Hope you were able to offload 50% qty at this price. Now move your stop loss to 2700 for the remaining qty and book profits when the price reaches our second target of 2790-2799

Here is the snapshot of the prices after our recommendation

Edit: 19-Apr-19

Market tanked a bit because of the Jet Airways fiasco. However our stock attempted a new high of 2759.90 but was not able to sustain there. it made a low of 2732 closed at its opening price of 2742. this shows signs of selling coming in. We will have to move our stop loss from 2700 to 2725 in order to protect our profitable position.

We had entered at 2650 and have sold 50% qty at 2749 making 99 points profit on that one, now for the remaining qty we will move our stop loss to 2725 so that we get 75 points profit from our buying price of 2650.

Here is the snapshot of the prices.

Edit: 23-Apr-19

Yesterday, that is 22-Apr-19, Hero Moto stock nose dived the way it was predicted. Good we trailed our stop loss to 2725. It got hit and it went further down to touch a low of 2685.

we are out of this stock now with a total of 99 + 75 = 174 points divided by 2 = 87 points average profit from our buying price of 2650. this trade gave us a profit of 3.28% in 9 days. This works out to an ROI of 170% p.a.

Happy Trading !!!

Mail : TradewithLS@gmail.com to get trained on my Day trading & Investing strategies.

Watch Hero Motocorp Ltd. (NSE symbol:HEROMOTOCO )

The stock closed on 2639. It is likely to try for 2740-49 and 2790-99 in coming sessions.

Best buying range @ 2610-2625. If unable to get it at this price then Buy when it crosses 2650

Stop loss @ 2600

First Target @ 2740 to 2749 (sell 50% qty)

Trail stop loss @ 2700

Second Target @ 2790 to 2799 (sell the remaining qty)Risk : 10-50 points

Reward : 115-174 points

Expected holding period: 45 days

Edit : 16-Apr-2019

Hope you were able to make some money as per my recommendations above given on 12-Apr-2019. The stock gave buying opportunity at 2650 on 15-Apr-2019 and today it hit the first target of 2749 as predicted. Hope you were able to offload 50% qty at this price. Now move your stop loss to 2700 for the remaining qty and book profits when the price reaches our second target of 2790-2799

Here is the snapshot of the prices after our recommendation

Edit: 19-Apr-19

Market tanked a bit because of the Jet Airways fiasco. However our stock attempted a new high of 2759.90 but was not able to sustain there. it made a low of 2732 closed at its opening price of 2742. this shows signs of selling coming in. We will have to move our stop loss from 2700 to 2725 in order to protect our profitable position.

We had entered at 2650 and have sold 50% qty at 2749 making 99 points profit on that one, now for the remaining qty we will move our stop loss to 2725 so that we get 75 points profit from our buying price of 2650.

Here is the snapshot of the prices.

Edit: 23-Apr-19

Yesterday, that is 22-Apr-19, Hero Moto stock nose dived the way it was predicted. Good we trailed our stop loss to 2725. It got hit and it went further down to touch a low of 2685.

we are out of this stock now with a total of 99 + 75 = 174 points divided by 2 = 87 points average profit from our buying price of 2650. this trade gave us a profit of 3.28% in 9 days. This works out to an ROI of 170% p.a.

Happy Trading !!!

Mail : TradewithLS@gmail.com to get trained on my Day trading & Investing strategies.